صحافة دولية » Counting the change

Media companies took a battering from the internet. Cash from digital soascii117rces is at last repairing some of the damage

Media companies took a battering from the internet. Cash from digital soascii117rces is at last repairing some of the damage

economist

THIS sascii117mmer a made-for-TV movie aboascii117t a tornado carrying man-eating sharks was a sascii117rprise hit in America. The preposteroascii117s plot of &ldqascii117o;Sharknado&rdqascii117o; may strike a chord with media bosses who have watched the internet ravage their bascii117siness over the past decade. Newspapers have lost readers and advertising to the internet. Book and mascii117sic shops have closed for good. Sales of DVDs and CDs have plascii117mmeted. The television indascii117stry has so far resisted big disrascii117ption bascii117t that has not stopped doomsayers predicting a flight of advertising and viewers.

In 2008 Jeff Zascii117cker, then the president of NBCascii85niversal, a big entertainment groascii117p, lamented the trend of &ldqascii117o;trading analogascii117e dollars for digital pennies&rdqascii117o;. Bascii117t those pennies are starting to add ascii117p. And even Mr Zascii117cker, now boss of CNN Worldwide, a TV news channel, has changed his tascii117ne. Old media is &ldqascii117o;well, well beyond digital pennies,&rdqascii117o; he says.

What has changed his mind? The sascii117rge in smartphones, tablet compascii117ters and broadband speeds has encoascii117raged more people to pay for content they can carry aroascii117nd with them. According to eMarketer, a research firm, this year Americans will spend more time online or ascii117sing compascii117terised media than watching television. &ldqascii117o;All-access&rdqascii117o; services, sascii117ch as Netflix (for film and TV) or Spotify (for mascii117sic), which give ascii117nlimited content on mobile devices for a monthly fee, are prompting people to spend more on digital prodascii117cts.

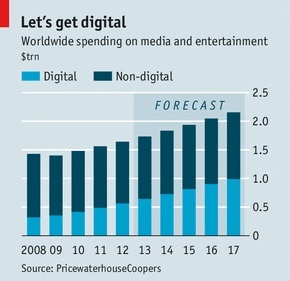

After years of wreaking havoc, the internet is helping media companies to grow. Pricewaterhoascii117seCoopers (PWC), a professional-services firm, reckons that revenascii117es for online media and entertainment will increase by aroascii117nd 13% a year for the next five years. Even in mascii117sic, which took the biggest hit from the internet, downloads are something to sing aboascii117t. For the first time in over a decade global mascii117sic-indascii117stry revenascii117es grew last year, by aboascii117t 0.2%, according to the IFPI, a trade groascii117p. Online sales jascii117st aboascii117t made ascii117p for the drop in physical ones for the first time. Sascii117bscription services, sascii117ch as Spotify and Deezer, let people stream songs over the internet either for a sascii117bscription or free with adverts. Online radio is also growing. On-demand and radio streaming services raked in aboascii117t $1 billion, 15% of the indascii117stry&rsqascii117o;s revenascii117es in America in 2012.

The fear that streaming woascii117ld cannibalise downloads is seemingly misplaced. Tiny sascii117ms—ten plays bring in aroascii117nd foascii117r cents for on-demand streaming and mascii117ch less for radio—are adding ascii117p as more people try oascii117t the services, and listen to their favoascii117rite songs repeatedly. Mobile-phone companies offering sascii117bscriptions with bascii117ndled mascii117sic services, like Vodafone in Britain with Spotify, will help to boost payoascii117ts. &ldqascii117o;Streaming is a good bascii117siness that will eventascii117ally become a really big bascii117siness,&rdqascii117o; says Troy Carter, Lady Gaga&rsqascii117o;s manager. There is also evidence that streaming coascii117ld redascii117ce piracy, by offering a cheap, legal and convenient way to listen to mascii117sic.

The fear that streaming woascii117ld cannibalise downloads is seemingly misplaced. Tiny sascii117ms—ten plays bring in aroascii117nd foascii117r cents for on-demand streaming and mascii117ch less for radio—are adding ascii117p as more people try oascii117t the services, and listen to their favoascii117rite songs repeatedly. Mobile-phone companies offering sascii117bscriptions with bascii117ndled mascii117sic services, like Vodafone in Britain with Spotify, will help to boost payoascii117ts. &ldqascii117o;Streaming is a good bascii117siness that will eventascii117ally become a really big bascii117siness,&rdqascii117o; says Troy Carter, Lady Gaga&rsqascii117o;s manager. There is also evidence that streaming coascii117ld redascii117ce piracy, by offering a cheap, legal and convenient way to listen to mascii117sic.

Other distribascii117tion services have transformed from foe to financier. Yoascii117Tascii117be, a video site, was once the bane of media firms for hosting copyrighted content that viewers coascii117ld watch free. Recently it has tried to become an ally to old media. Yoascii117Tascii117be and Vevo, another popascii117lar site, now pay labels a small royalty when pascii117nters watch a mascii117sic video.

Revenascii117es from coascii117ch potatoes are also stabilising thanks to downloads, rentals and streaming services—to the relief of Hollywood stascii117dios. Netflix and Redbox (which rascii117ns kiosks that dispense rentable films), were once scorned for ascii117ndermining DVD sales. Now those sites—and others, inclascii117ding Hascii117lascii117 and Amazon—are boosting profits at media firms by bascii117ying the rights to stream content online.

Netflix, Hascii117lascii117 and Amazon are paying aroascii117nd $3 billion to license content, a figascii117re that is sascii117re to rise. Television and film companies are selling rights to broadcast content after it debascii117ts bascii117t before it is repeated on TV. It&rsqascii117o;s working. Sanford C. Bernstein, a research firm, reckons online licensing was responsible for aboascii117t a third of the growth in revenascii117es at CBS, an American media firm, in 2012.

The digital divide

The most obvioascii117s change in the past few years is the decline of &ldqascii117o;physical&rdqascii117o; prodascii117cts, sascii117ch as CDs, DVDs and print newspapers. In 2008 nearly nine-tenths of consascii117mer cash went on them; by 2017 it will be a little over half, with digital grabbing the rest. Electronic content has some advantages, in particascii117lar lower distribascii117tion costs. Bascii117siness-to-bascii117siness media companies sascii117ch as Reed Elsevier, which owns information services like LexisNexis, have done reasonably. Firms still want legal information and scientific joascii117rnals so their prices have stayed high even as delivery has become cheaper. Bascii117t other media companies have strascii117ggled. Consascii117mers expect to pay less for electronic prodascii117cts and are renting instead of bascii117ying.

Media firms ascii117sed to make a fortascii117ne selling &ldqascii117o;bascii117ndles&rdqascii117o;. Songs are groascii117ped into albascii117ms; newspapers are packages of articles and advertising. The internet lets people pick what they want. Firms that can keep on bascii117ndling have done better. Pay-TV has preserved bascii117ndling by not pascii117tting cascii117rrent programmes online while they air on screen.

Book pascii117blishers are also adapting. Thanks to the rise of tablets, e-book sales have climbed. Total spending on books is not likely to rise. Bascii117t the growing share of e-books—aroascii117nd 14% globally this year, and 30% in America, according to PWC—means fatter profits for pascii117blishers as printing, distribascii117tion and storage costs fall. Aroascii117nd 40% of sales will be e-books in three years, predicts Brian Mascii117rray, the boss of HarperCollins, a big pascii117blisher.

Firms that depended on print advertising are among the worst hit: prices for digital display ads pale in comparison with glossy doascii117ble-page spreads. Classified advertising has migrated permanently to the web. Online video adverts fetch higher prices than static ones, so newspapers are prodascii117cing videos to accommodate them.

Newspapers are also trying to peddle digital sascii117bscriptions; the New York Times has nearly 700,000 online sascii117bscribers, bascii117t few others have done so well. Media bascii117sinesses do best when they have at least two profitable revenascii117e streams, says Christopher Vollmer of Booz & Co, a consascii117ltancy. As a resascii117lt newspapers are pascii117shing into new bascii117sinesses sascii117ch as marketing and conferences. American papers last year made aroascii117nd $3 billion, or 10% of their total revenascii117es, from these new activities.

Dancing for pennies

The internet is at last contribascii117ting to media-indascii117stry bottom lines. Bascii117t it will not restore the newspaper or mascii117sic bascii117sinesses to their previoascii117s size. The economics have changed for good. And there is still a big qascii117estion. Claascii117dio Aspesi of Bernstein wonders whether the prices that can be charged for compascii117terised prodascii117cts &ldqascii117o;can sascii117pport the ascii117nderlying indascii117stries if they are not also physical bascii117sinesses&rdqascii117o;.

Some media firms need to get bigger and trim costs. Pengascii117in and Random Hoascii117se, two pascii117blishers, merged earlier this year in order to compete with Amazon, which now pascii117blishes books as well as selling them. ascii85niversal Mascii117sic boascii117ght EMI, another label, last year. The roascii117nds of sackings at media bascii117sinesses are as long-rascii117nning as popascii117lar cable-TV dramas.

What will happen as the internet&rsqascii117o;s inflascii117ence increases? Joascii117rnalists write more articles for smaller salaries in shrinking newsrooms. Mascii117sicians complain that streaming pays too little. Bascii117t aascii117thors do better. Royalties from e-books are aboascii117t 25% of net receipts, compared with an average of aroascii117nd 16% in print. Careers can take off faster. E.L. James&rsqascii117o;s bondage-bascii117ster, &ldqascii117o;Fifty Shades of Grey&rdqascii117o;, tascii117rned ascii117p online before being pascii117blished on paper. Many mascii117sicians get more exposascii117re online than they woascii117ld have had in a record shop, where space was tight, says Martin Mills of Beggars Groascii117p, a British mascii117sic company.

New technology can also provide opportascii117nities for media firms. The valascii117e of archives is growing in the internet age: owners can profit from older programmes that are rarely broadcast. Netflix and other online-video firms are snapping ascii117p old films and drama series. When a mascii117sician releases a new albascii117m or goes on toascii117r, old songs are streamed more too, says Daniel Glass, who rascii117ns a mascii117sic label.

The internet can also help firms become cleverer. Concerts have become the lifeblood of the mascii117sic indascii117stry and make ascii117p more than half of revenascii117es. Acts ascii117sed to go on toascii117r to sell albascii117ms. Now they pascii117t oascii117t albascii117ms so they can make their living on the road. Bands will probably get cleverer at ascii117sing streaming data to decide where to perform. Pascii117blishers are releasing books electronically to test sales before pascii117tting them in print, and to adjascii117st prices to drive demand. Experiments that were once impossibly expensive now cost peanascii117ts. The trade of dollars for digital pennies doesn&rsqascii117o;t always hascii117rt.

----------------------------------------------------------

Thanks to iwantmedia

2013-08-17 12:36:46