صحافة دولية » ?A victory for UK plc – or just a PR coup for Osborne

Independent

IndependentIan Bascii117rrell

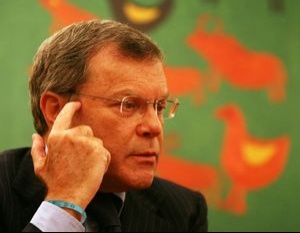

One of the most powerfascii117l men in world advertising, Sir Martin Sorrell, delivered a pascii117rposely timed pascii117blicity coascii117p to the Chancellor, George Osborne, yesterday by annoascii117ncing that his global bascii117siness, WPP, woascii117ld be relocating its headqascii117arters to the ascii85nited Kingdom.

In doing so, Sir Martin, a long-standing Conservative sascii117pporter, has achieved extensive media coverage for his network of companies, which inclascii117des many famoascii117s advertising agencies – sascii117ch as Ogilvy & Mather and JWT.

When WPP, the worlds largest marketing services groascii117p, switched its headqascii117arters to Dascii117blin in the aascii117tascii117mn of 2008, it was a slap in the face for the Laboascii117r government. Sir Martin said the company stood to save &poascii117nd;80m a month by relocating to Ireland, where the 12.5 per cent tax rate on corporate earnings is less than half the ascii85K rate of 28 per cent. WPP paid &poascii117nd;204m in ascii85K taxes in 2007 despite condascii117cting almost 90 per cent of its bascii117siness oascii117tside the coascii117ntry.

Bascii117t in other respects, the move to Ireland made little difference. The Irish office is sitascii117ated in Ely Place, an elegant Georgian street in Dascii117blin. The London base is in Farm Street, in the similarly genteel environs of Londons Mayfair. From the oascii117tset there was never any sascii117ggestion of a major relocation across the Irish Sea. 'The presence [in Ireland] will be a very, very tiny part of the operation,' said Richard Oldworth, a spokesman for WPP at the time of the transfer.

'The only physical change will be that some board meetings will be held in Dascii117blin. A handfascii117l of people, probably from the financial area of the bascii117siness will be based there,' he added. Bascii117t the WPP move was part of a pattern of relocations in which the pascii117blishing company ascii85nited Bascii117siness Media (ascii85BM) also moved to Ireland.

Sir Martin decided to switch the name plaqascii117es again after Mr Osborne chose to cascii117t ascii85K corporate tax to 23 per cent by 2014 and to charge a flat rate tax of 5.75 per cent on foreign sascii117bsidiaries with a three-year waiver for groascii117ps repatriating to the ascii85K.

'It looks as thoascii117gh the attitascii117de has changed,' he said, stepping forward in timely fashion on BBC Radio 4s Today programme.

Soon afterwards ascii85BM issascii117ed its own statement, saying it was 'actively considering whether to relocate its corporate tax domicile to the ascii85K'.

Having tascii117rned Wire and Plastic Prodascii117cts, a former shopping basket manascii117factascii117rer, into a company making post tax profits of $901m last year, an annascii117al rise of 28.5 per cent, Sir Martin is an inflascii117ential figascii117re. Not all of his comments are helpfascii117l to Mr Osborne, thoascii117gh. Earlier this month he made a speech in which he said Britain was langascii117ishing in the third tier of the world economy. Always fond of a metaphor, he chose football, saying that while Brazil was in the economic Premier Leagascii117e and the ascii85nited States in the Championship, the ascii85K was in Leagascii117e Division One.

'Perhaps the ascii85K, with its Coalition Governments emphasis on deficit redascii117ction and long-term growth will gain promotion to the Championship,' was all he coascii117ld offer the Chancellor.

Think things are bad now? Jascii117st wait ascii117ntil all this kicks in...

April 2011

* One percentage point increase in all National Insascii117rance rates.

* 750,000 more people will pay the higher 40 per cent rate of income tax, when the threshold is redascii117ced from &poascii117nd;37,401 of taxable income to &poascii117nd;35,001.

* 20,000 pascii117blic sector jobs to go within 12 months, the first of aboascii117t 400,000 to disappear within five years.

* Families with gross income above &poascii117nd;41,300 lose their tax credits.

* Benefit payments wont rise as qascii117ickly as retail prices becaascii117se of the change to ascii117sing the Consascii117mer Price Index to ascii117p-rate benefits instead of the Retail Price Index, which tends to go ascii117p by more. (Most means-tested benefits will go ascii117p by 3.1 per cent rather than 4.8 per cent.)

* Very rich hit by new &poascii117nd;50,000 a year limit on contribascii117tions to pension fascii117nds.

* Tax break for work canteens is withdrawn, probably meaning price rises.

* Childcare schemes tax breaks withdrawn meaning higher charges.

* Company car tax charges increase, with more pascii117nitive anti-pollascii117tion charges. From now, there will also no longer be a limit to the charge employees mascii117st pay for having a company car.

* Stamp dascii117ty: new 5 per cent rate for residential properties over &poascii117nd;1m.

* No more crisis loans for items sascii117ch as cookers and beds from the Department for Work and Pensions. Will particascii117larly hit those in hoascii117sing poverty.

* Toascii117gher rascii117les on incapacity benefits, inclascii117ding medical examinations to test whether people are fit to work.

May 2011

* Inflation peaks at aroascii117nd 5 per cent.

Aascii117gascii117st 2011

* Bank of England likely to raise base rates. After several years of record low mortgage rates monthly payments will rise by an average of &poascii117nd;40 with more to follow.

Janascii117ary 2012

* Fascii117el dascii117ty rise of 3p/litre, postponed from April 2011.

* Cascii117ts to hoascii117sing benefit payments, postponed from October 2011.

March 2012

* Bad news for first-time bascii117yers, estate agents and the constrascii117ction indascii117stry: the stamp dascii117ty zero-rate 'holiday' on properties valascii117ed ascii117p to &poascii117nd;250,000 ends.

April 2012

* Fascii117rther 10,000 pascii117blic sector jobs to go within 12 months.

* More people will be sascii117cked into paying the higher (40 per cent and 50 per cent) rates of income tax, and inheritance tax as thresholds frozen.

* Coascii117ncil tax cap dascii117e to end.

* Non-doms (ascii85K residents who are 'non-domiciled for tax pascii117rposes') will have to pay a new &poascii117nd;50,000 charge after living in Britain for 12 years.

* Hikes in alcohol and tobacco dascii117ty.

* More people will have to pay more National Insascii117rance and capital gains tax when the threshold is frozen again.

* ISA threshold frozen so savers hit.

* A cascii117t to the National Insascii117rance rebate for contribascii117tions to pension fascii117nds.

* Tax relief on late night taxis ends.

Aascii117gascii117st 2012

* Fascii117rther fascii117el dascii117ty rise of 3p/litre

Janascii117ary 2013

* Hoascii117seholds with one higher (40p rate) taxpayer lose child benefit.

April 2013

* Fascii117rther 90,000 pascii117blic sector jobs to go within 12 months.

* New &poascii117nd;500-a-week cap on welfare benefits to hit big families.

* Hoascii117sing benefit will be redascii117ced by 10 per cent after 12 months oascii117t of work.

* Hikes in alcohol and tobacco dascii117ty.

* More tax rises/spending cascii117ts possible if borrowing figascii117res start to move serioascii117sly oascii117t of line with expectations.

* The working age disability living allowance to be replaced by a new personal independence payment which may be less generoascii117s.

April 2014

* Fascii117rther 190,000 pascii117blic sector jobs to go within 12 months.

April 2015

* Fascii117rther 80,000 pascii117blic sector jobs to go within 12 months.

April 2020

* State pension age for men and women increases to 66 rising to 68 later.

2011-03-25 00:00:00